What impact will Trump's second term have on the semiconductor industry

With the 2024 US presidential election, Trump won. So, what impact will he have on the semiconductor and even the technology industry after he takes office? The semiconductor industry is not only part of the market, but also part of the global economy. Coupled with the continuous upgrading of artificial intelligence (AI) in almost all fields, semiconductor policy will have geopolitical significance. Trump and Harris's position on the US "CHIPS Act" has attracted widespread attention in the industry.

Tariffs replace subsidies: The semiconductor industry faces a shock

Trump's return heralds a huge shift in semiconductor policy. The prospects of the "CHIPS Act" are unclear, and the new government tends to replace subsidies with high tariffs. In addition to his position on the "CHIPS Act", Trump's remarks that "Taiwan, China has taken away the US chip business and hinted that Taiwan, China needs to pay for the protection of the United States" are also controversial in the industry. He said that after returning to the White House, tariffs will be imposed on Taiwan's chips, even though more than 90% of the world's advanced chips are supplied by TSMC. "We've invested billions of dollars to allow wealthy companies to come in and borrow money and build chip companies here," Trump said. However, Trump's views differ somewhat from those of his vice presidential running mate, JD Vance, who believes that Taiwan's semiconductor industry is vital to the U.S. national interest. From an international relations perspective, TSMC's investment in advanced manufacturing facilities in the United States meets U.S. requirements. In addition, TSMC's willingness to invest in the United States also means higher costs, such as increased labor costs, and this additional financial burden may be interpreted as a kind of "protection fee."

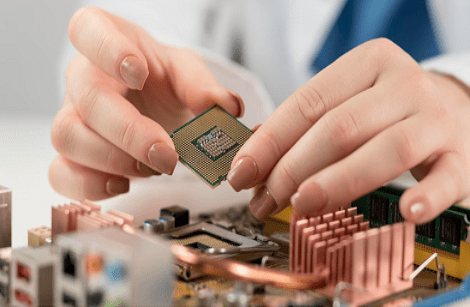

Talent shortage in Silicon Valley: innovation is at risk

Under Trump's re-implementation of the "America First" policy, the high-tech industry faces a dilemma. On the one hand, efforts to restore manufacturing may promote the increase of domestic technology jobs; on the other hand, stricter immigration policies may cut off the influx of global talent. As visa restrictions tighten, technology giants may find it difficult to fill key positions, which may slow innovation and growth. “I expect some workforce development requirements may be relaxed under Trump,” said Sanjay Patnaik, a senior fellow at the Brookings Institution.

US-China Showdown: Tech Cold War Intensifies

A second Trump term is expected to heighten tensions in the US-China tech competition. Tighter export controls on advanced semiconductor technology and greater pressure on Chinese tech companies are expected. Trump’s stance on Taiwan is particularly worrisome for the industry. “You know what, Taiwan, they took our chip business… and they want to protect it,” he recently said. Such an escalation could lead to a more fragmented global tech ecosystem, divergent standards and less international cooperation. “Under a Trump presidency, there could be large tariffs on China, and as we’ve seen before, that will provoke a Chinese response, such as China’s ban on Micron Technology chips in May 2023,” warned Patrick Moorhead, CEO of Moor Insights & Strategy. The incident was a direct response from China to US export controls and technology sanctions, highlighting the intensity of the confrontation between the two sides.